taxing unrealized gains is unconstitutional

Overall Americans oppose taxing unrealized gains by a 3 1 ratio 75 25. It Could Be Unconstitutional.

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

The 16th Amendment allows Congress to tax income The Congress shall have power to lay and collect taxes on incomes from whatever source derived without.

. Fifth a tax on unrealized capital gains is flatly unconstitutional. It will likely be challenged in court as unconstitutional. Essentially what theyre doing is violating property rights.

Under current tax law unrealized gains are. The presidents new budget plan calls on Congress to tax wealthy Americans unrealized capital gains. The constitution is very clear when it states that tax has to be apportioned among the several states and cant be specific.

76 of respondents identifying as independents are opposed to taxing unrealized gains. Constitution bars the federal government from imposing direct taxes unless they are. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why.

The Biden administrations idea to tax billionaires unrealized capital gains may sound good to the tax-the-rich crowd. The Democrats plan to tax billionaires unrealized capital gains has a problem. Rahn argued today that capital gains taxes impede.

The constitution may not even permit taxation of unrealized gains. The Biden administrations idea to tax billionaires unrealized capital. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million.

In light of the capital gains tax resetting from its 2003 levels to its pre-Bush levels Dr. Lets look at actual Supreme Court cases to help decide if taxing unrealized gains is constitutional. Janet Yellen proposed the idea of taxing unrealized gainsIts extremely unconstitutional.

Ira Stoll 3282022 350 PM. The tax would be imposed regardless of whether gains were realized. That approach would shift the direct burden of taxation from corporations to shareholders.

Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital gains. The Heritage Foundation said that the tax is unconstitutional.

Legal obstacles loom for Democrats proposal. If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional. Further the Biden tax is likely unconstitutional.

In practice it would be an unworkable and arguably. If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional. Article I Section 9 of the US.

Answer 1 of 4. An income tax that was imposed by the Revenue. Washington Post columnist Henry Olsen explains why this is not only a terrible idea but also unconstitutional.

The Problems With an Unrealized Capital Gains Tax.

Billionaires Tax Faces Constitutional Political Hurdles

The Madness Of Taxing Unrealized Capital Gains Mises Wire

The Left S Flirtation With Capital Gains Taxes Ignores The Fact That They Re Unconstitutional Freedom Foundation

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Oops Manchin Now Denounces The Democrats Wealth Tax On Billionaires Mish Talk Global Economic Trend Analysis

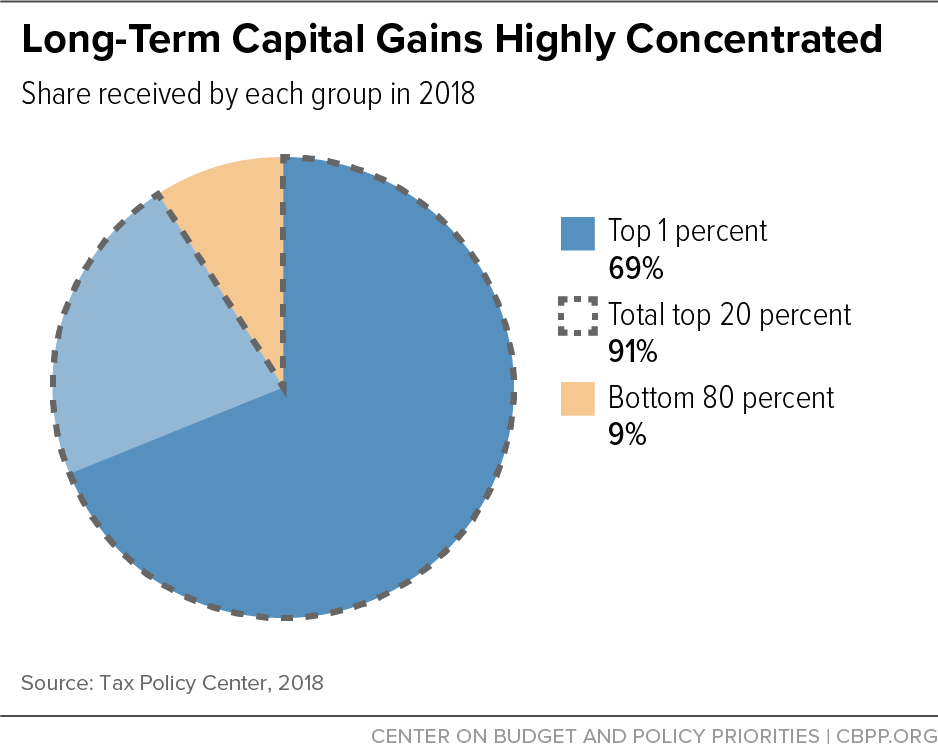

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

Washington S Hunt For Revenue Turns Up An Unworkable Tax On Wealth Discourse

/cdn.vox-cdn.com/uploads/chorus_asset/file/19257471/1144341633.jpg.jpg)

Ron Wyden S Capital Gains Tax Plan Would Hit And Change Philanthropy Vox

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

An Inside Look At Biden S Proposed Unrealized Gains Tax Investment U

Commentary Trash The Billionaires Minimum Income Tax

![]()

Taxing Unrealized Capital Gains The Crazy Fed Proposal To Tax Profits That Don T Exist Scottsdale Bullion Coin

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

Adam Smith Capitation And The Nonsense That Is The Proposed Aier

Digging Further Into The Question Is Taxing Unrealized Gains Constitutional Mish Talk Global Economic Trend Analysis